Game Stop Yourself before it's Too Late

Updated February 2, 2021

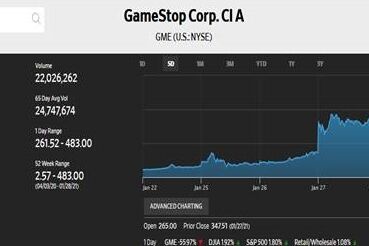

Shares of Game Stop (GME) soared over 40% on Friday Jan. 29, only to drop over 30% on Monday Feb. 1, and then another 58% on Tuesday Feb. 2 to close at $94.78 per share. At one point last week, GME shared traded over $450 per share.

Investing in the stock market is, by nature, a risky proposition. And until very recently it is generally a game rigged to benefit those with the guts and financial heft to control the market, beat the spreads and exploit the little guy. But some very clever amateur investors have beaten some of the Wall Street bigshots at their own game, but buying and holding shares in small publicly traded coming with heavy short position n the stock. The list of these companies includes the the movies theater company AMC, but the most eye popping example is Game Stop, the video game retailer that sell video games from their store in shopping malls across the country. Game Stop (GME).

What is a Short Squeeze

A short squeeze occurs when the price of a stock jumps sharply higher, forcing traders with short positions to buy it in order to mitigate their losses. Their scramble to buy share only adds to the upward pressure on the stock's price and forces it higher. In the case of GameStop, this squeeze worked because the investor who had bought the shares earlier held on to the stock, even as it soared in value these past few weeks.

“It’s extreme capitalism gone wild. We’re a nation of gamblers.”

- Andrew Left from Citron Research

How Did This Happen?

Over the past year or so, amateur day traders have plowed into the market. Some saw opportunity after stocks tumbled last spring, some may have been suffering gambling withdraw when sport leagues shut down last spring. All this has been made easier by the free trades available through platforms like Robinhood and E-Trade.

Some of these overzealous amateurs are buying shares of Game Stop, but many are placing their own options bets the opposite side of the shorts, essentially doubling down and creating exponential pressure, and exponential risk. These bets involve contracts that give them the option to buy a stock at a certain price in the future. If the price rises, the trader can buy the stock for cheap and sell it for a profit. (In practice, many traders sell the options contract itself for a profit or loss instead of actually buying the shares.

Why Did this Happen?

There are a confluence of factors that many say contributed to this phenomena and allowed this to happen. First, the pandemic has kept people locked up up at home an they've been studying research and have become day traders. Second, tools and apps like Robin Hood have made trading easy and have even 'gamified' it, so that anyone with a cell phone and a few hundred dollars can get in. Robin Hood even offers fractional shares, so even someone who doesn't have enough money to buy a share of Tesla or Apple, can but fraction of a share. This is dangerous. Third - an in my opinion the biggest - factor is that the internet, specially Reddit threads, ave allowed people to come to one place online and exchanges ideas. The Reddit thread in question is called WallStreetBets, and it is there where it all started. Regular investors have grown tired of losing at the investment game that they feel is rigged, with the cars stack against them. Hedge funds and high speed traders have always won the bid and gotten the best price, and the little guys have little or no chance of winning by playing by the established rules. If you spend a few minutes perusing the posts comments on the WallStreetBets thread you will undoubtedly detect more than just a hint of rebellious tendencies. These people are not just out to make a few bucks, they want to take down the giants and make a statement. They get the first call, their order take priority in the queue, and the little guy gets the shaft. By identifying the one thing that they could turn against the big guys, short selling, they have managed to stick it to the man. And what isn't fun about getting one over on the big bad bully? But, this is a bubble and bubbles always burst.

Eventually the wall of solidarity will crack, and those who have made a bunch of money on this game will capitulate and sell their stock to the hedge funds who are trying to cover. Then the next guy will do it and the route will be on. But if you've f you've got a rebellious side to you and you're interested in joining the revolution, just be careful and prepare for a long, rough ride. As of this post shares of Game Stop had fallen over 50 in one trading day. Buckle up!